TEXT

John Manley, Canada’s former Finance Minister, and current senior Business Advisor at Bennet Jones, speaks with Vassy Kapelos, a journalist.

He is concerned that Canada’s central bank will rachet up the interest rate to control inflation, by suppressing demands for goods and services.

He is concerned that rising interest rate will cause an economic recession. He believes that it is a fair assessment by another economist, who predicts that the odd for a soft landing of the economy is remote.

He believes prices will increase because of many factors, such as the ongoing war in Ukraine, which is impacting the prices of commodities, energy, food, nutrients needed for fertilizer, etc.

In his opinion, the government doesn’t have many options. The central bank is independent, an importance feature of our system that must be preserved, but that means the bank will raise interest rates, and the government cannot stop that.

To help those segments of the population that will suffer hardships because of high interest rates, rising prices and constrained supply, the government must accelerate the measures that it already has. Examples of those measures are benefit indexation, workers’ benefits, housing benefit, etc.

Mr. Manley believes we are in for a rough ride, because of food price increases and the things that will ripple off of those increases.

He believes that the inflationary pressure will decrease by the time of the 2025 elections, and the Liberals will not be as vulnerable as the Democrats in the US, who will go to the polls in November. People are consumed by worries, about price increases, mortgage payments, etc. Although it is a global phenomenon, the government will take a lot of heat from the opposition for the problems.

EXAMPLES OF SENTENCES WITH SOME NEW WORDS

Assessment:

- His assessment of the situation is fair.

- My tax assessment is too high.

- This project needs an environmental assessment.

- The assessment for the course involves written assignments.

Measure:

- The government puts in place many measures to help people.

- This house measures 13m x 26m.

- The measure of a man’s real character is what he would do under stress.

Odd:

- The odd of winning the US Powerball lottery is 1 in 292 million.

- 1,3,5 are odd numbers.

- It is odd that he’s absent today.

- He is at odd with his partner.

Suppress:

- The Central Bank rises interest rate in hope to suppress high inflation.

- There is fear of voter suppression in some US States.

- Many evidences for the court case have been suppressed.

VIDEO TRANSCRIPT

VIDEO: How long could Canadians be dealing with high inflation?

CBC’s Vassy Kapelos’ interview with John Manley, Canada’s former finance minister.

VK: John Manley is a former deputy prime minister and Minister of Finance; he’s now a senior business advisor at Bennett Jones.

Hi Mr. Manley. Great to have you back on the program.

JM: Thank you.

VK: I want to ask you about what we might hear or what we should hear from the government tomorrow, when the current Finance Minister delivers a speech addressing inflation, but first, as a former finance minister, I wonder how concerned you are about the state of the economy as at this moment.

JM: I’m very concerned about it because inflation is rampant and central banks are doing what central banks do in inflationary time, and they are ratcheting up interest rates; that means our chances of a soft landing in our economy are becoming increasingly remote; which means we could be heading into a recession.

VK: I was speaking with Doug Porter the other evening on the program, the chief economist for BMO, and he put the odd of a recession in 18 months at 50/50. Do you think that’s a fair assessment?

JM: I think so. You know you never know, I mean there are a lot of factors out, but most of them is to the negative. You know we’ve got an ongoing war in Ukraine which is impacting prices in a lot of Commodities including energy, but also impacting food and food distribution and the nutrients that need to be used for fertilizer.

Those are external pressures that we don’t know how that’s going to play out.

We have to slowdown in China because of their Covid policies.

And, by the way, don’t forget about Covid; it’s always able to make a comeback; it’s been a very resilient, you might say, virus; with lots of different faces to it.

I can’t think of any of the possibilities that edges to the upside. I think everything is kind of negative right now.

VK: So what does that mean? I’ll start first from a policy perspective and then I asked you about from a Communications perspective; but first from a policy perspective for federal government.

JM: Well, they don’t have a lot of options, really. I mean the Bank of Canada is independent; by the way that is a critically important feature of our system; it needs to be preserved. But that independence means that they will be raising interest rates, and we saw it in the U.S. today. So, expect more to come.

About the most to the government can do is try to address the segment of our population that is most directly impacted, that are having, those people that are having trouble putting food on the table or, you know, conducting their normal lives.

One that perhaps the government can try to help, if they do something like an overall tax reduction; that doesn’t, that’s not targeted enough. And what the bank is trying to do by raising interest rate is to suppress demand a little bit; especially when supply is constrained in so many areas; but some people are going to find real hardship in this; and they’re the ones that the government’s usually needs to step in and help.

VK: Does that necessitate anything new or what’s anticipated tomorrow, for example, from Minister Freeland is kind of recapping what the government already has to offer those segments of the population that you just highlighted. So, for example, things that are indexed, benefits that are indexed to inflation, or the Canada workers’ benefits, the housing benefit, things like that the minister, you know, my understanding, is planning to talk about, but nothing new really in that speech.

JM: Those are all good things, but the problem with them is that they lag, because the increase in each of those only happens after the inflation numbers have been proven out for a period of time. So, if you are looking to do something right away, then you need to do something a little differently, even if it just means accelerating some of those increases and working out the details later. Because, you know, I think we’re in for a rough ride here; there’s no other way to look at it. When you just look at, even the food supply situation and the impact that will have on, you know, basic cost of living, everything from bread and pasta, right through to all the things that ripple off of that.

VK: I think against the backdrop of that, it’s fair to say that Canadians are really consumed with a lot of this stuff right now. They’re worried about not only, you know, the price of what’s happening right now, but what those rising interest rates mean for their mortgage, and then the possibility of a recession, and what that could mean.

From a political / (slash) communication perspective; as someone who spent a long time in government, you know what? How big of a vulnerability for the Liberals right now is this?

JM: Fortunately for them, they’re not facing in the election in the next year-and-a-half; unfortunately for President Biden, his party goes to the polls this November; and I think that’s going to be very unfortunate timing.

These things usually take a bit of time to work their way through. Some of this inflation, and I think it’s important for Canadians to remember that this is not unique to Canada, this is a global phenomenon right now. But some of those supply challenges will begin to be satisfied, as China comes back online, as we get more certainty around oil production and other energy supplies; so by the time we get to the 2025 federal elections things could look quite a bit different, but I think that in the meantime it’s going to be important for the government to show that they actually understand how hard this is for people, how impactful it is, and they’re going to get a lot of heat for, what some of the opposition side will say that it was their irresponsibility in allowing this to happen the first place.

OTHER READINGS:

IDIOMS

- Balance the book.

- Bring home the bacon.

- Egg nest.

- Cook the books.

- Golden handshake.

See more at this site:

12 English money idioms: Phrases & expressions about finance

VOCABULARY SELF-TEST

Make something go faster.

The government must _____ the vaccination program to limit the spread of the virus.

The ______ of this car is so hard, you feel pushed against the seatback.

Advisor or adviser

Person who gives advices

If you don’t know how to invest, find a financial ____ to help you.

Assessment

The act of judging or deciding the amount, value, quality, or importance of something.

The economist’s ______ of the current situation is correct.

Students will be _________ at the end of the semester by way of a written exam.

My tax assessment is too high this year.

Commodities

Products that can be traded, bought, or sold.

Some _______: Wheat, corn, coffee bean, soy bean, cotton, metals, coal, oil, natural gas.

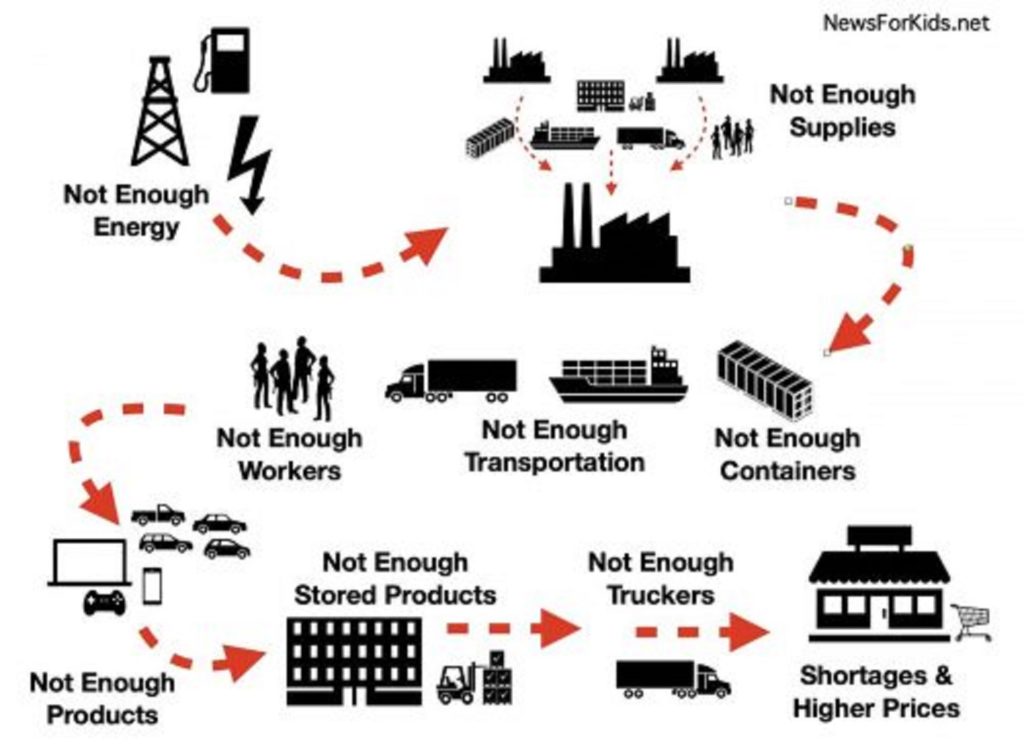

Constraint

Things that control what people can do by imposing limits.

There are shortages of many things today because of _______ in the production and distribution of goods.

Because of financial _________ the company is facing, there will be no salary increase this year.

Consume

Eat, use up.

People are ______ with worries about the economy.

The lion must ______ between 5 and 12 kg of meat each day.

This car _______ a lot of fuel.

Fertilizer

A natural or chemical substance that is given to plants to help them grow better.

Some _______ are made with phosphate rock.

Former

Before the present time

Russia was part of the _________ Soviet Union (USSR).

Hardship

Difficult conditions of life.

During the economic recessions, some people suffer great _____

Many people in the world are still living in _______; they are suffering hunger, homelessness, etc.

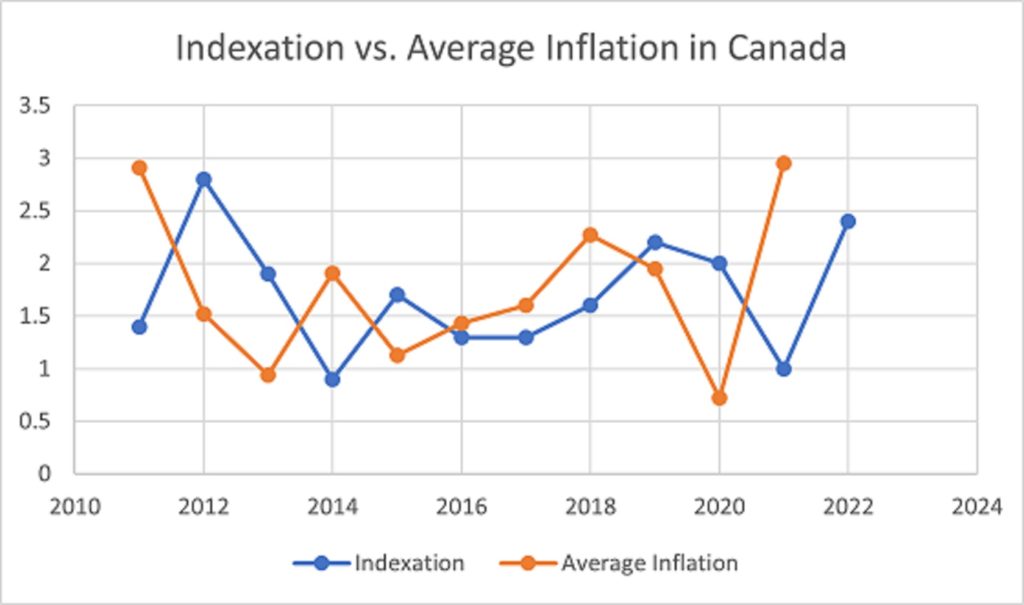

Indexation

Varying a payment according to the variation of the inflation index.

In Canada, government pensions are ________ to inflation.

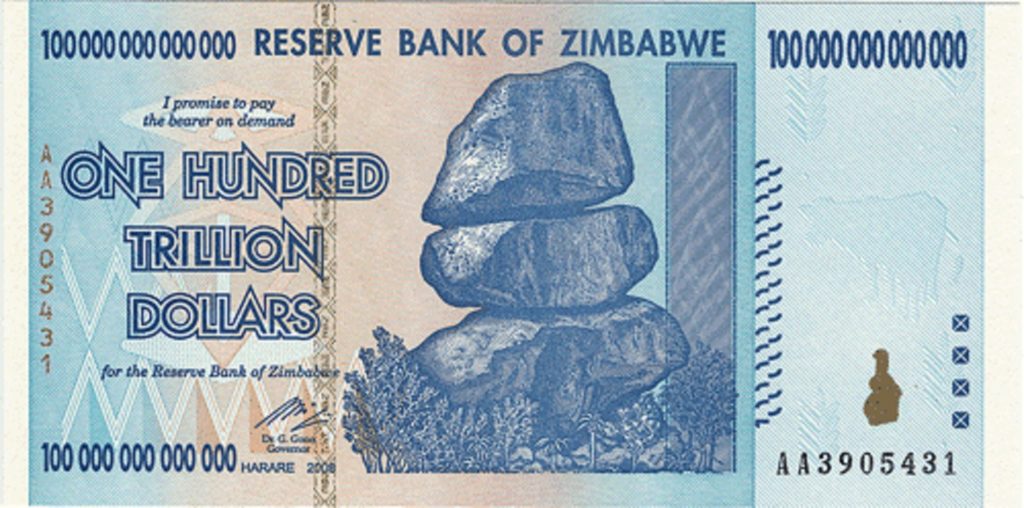

Inflation Inflate

Continuous rise in prices / Filling something with air.

The ________ rate in Zimbabwe was so high, the government issued One hundred trillion Dollar bills.

Part balloons are _______ with helium to make them float.

Measure

A method of dealing with a situation/ To find out the size of an object.

The government have developed ______ to limit the spread of the new virus.

This table ________ 1 meter by 1.5 meters.

Mortgage

Money that a person borrows to buy a house and pays back in several payments .

With higher interest rate, ______ payments will exceed the budget of many people .

Nutrient

A substance that plants or animals need in order to live and grow.

Potash, phosphate are ______ used in the production of fertilizer.

Rice needs ______ , light and water.

Milk is a ______ for babies.

Odd in Canada is an odd sight.

Probability, chance/ Uneven number/ Strange

The ______ of an economic soft landing is low right now.

1,3,5,7 are ______ numbers

An exterior palm tree seen in Canada is an ______ sight

Preserve

To keep and to protect.

The independence of the central bank must be ______ .

We must ______ the earth, it’s our only planet.

Poll

Election/ opinion survey.

The US will go to the ______ in November 2022 to elect new members of the Congress.

Opinion ______ are showing that the opposition will win control of Congress in November.

Ratchet – Ratchet up

A ______ is a device that allows movement in one direction only, by one small step with each movement of the lever.

____ up the interest rate is to increase it gradually.

Remote

Far, isolated.

Hanga Roa is a very ______ island, far out in the Pacific Ocean.

His chance for promotion is ______ , he doesn’t have management skills.

Ripple

Small waves on the water surface, sometimes caused by a water drop or a stone that fell into the water.

_____ off: Spread out like a ripple.

The increase in food price will ______ off into other areas, for example, workers will ask for higher wages because they need more money to buy food; then higher wages to cause increases in the prices of other products, etc.

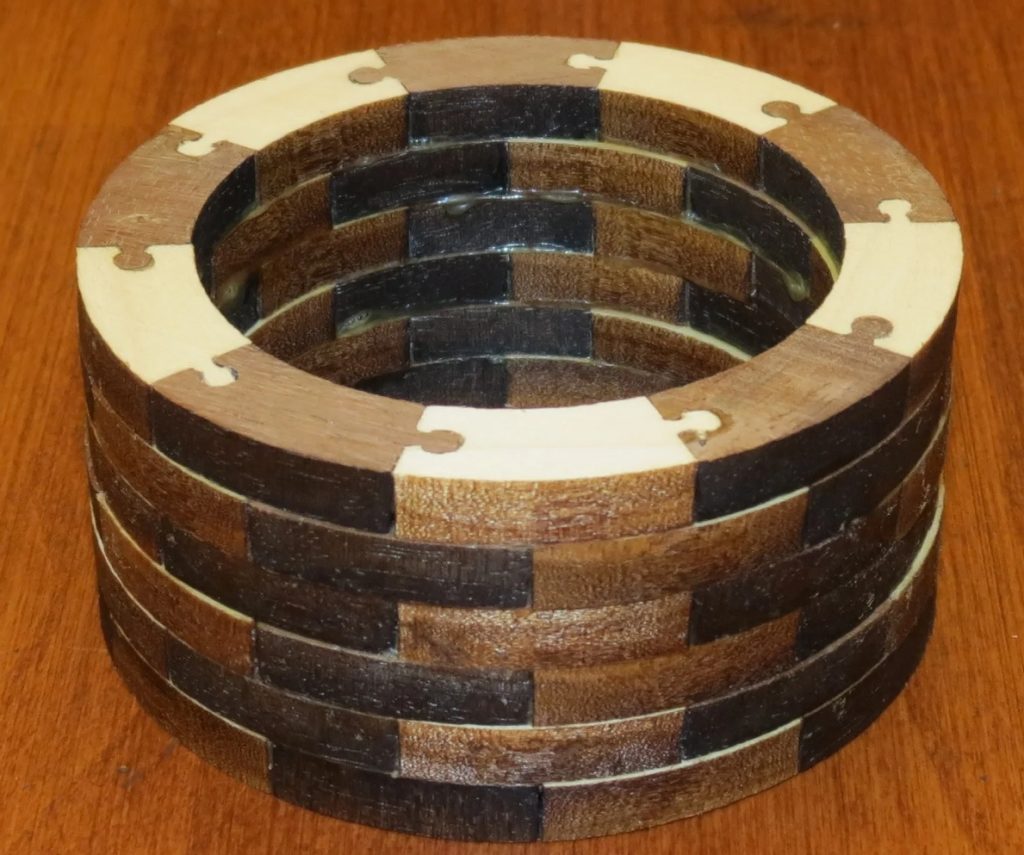

Segment

Part of a whole, such as a circle, a market, a population.

In the event of a recession, some ______ of the population will suffer more than others.

Wooden bowls are often made by joining ______ of wood.

Senior

Higher in rank, older.

A general is a ______ officer.

Stores usually offer discount to ______ citizens (65 years – old or older).

Soft landing

A mild slowdown of the economy/ A gradual, smooth landing of an airplane or a dropping object.

With rising prices and high interest rate, the chance of a s ______ of the economy is small.

The skydiver glides down to a ______ .

Suppress – Suppression

To end something by force/ To prevent something from being seen or expressed.

Photo: Forest fire ______ from the air

People fear voter ______ in some US States.

The sentence was suppressed from the speech delivered by the author.

Take heat

Endure the pressure, stress.

The government will ______ ___ from the opposition for this scandal (The opposition will put a lot of pressure on the government).

IDIOM: If you can’t ______ , get out of the kitchen: If you can’t endure the stress, leave or give up.

Phenomenon

A thing, event that is unusual, interesting / A person who is unusually successful.

The Northern Light (aurora borealis) is a beautiful natural ______

This singer is a new ______ , no one has risen to success so quickly.

Pressure

Force per unit of area. Force exerted by a compressed gas. Demands put on a person

Inflation is putting a lot of _______ on many people.

The tank exploded because the _____ was too high.

He is a tough person, he can take the ______ of the job.

SPEAKING PRACTICE

MAKE A SENTENCE WITH EACH OF THE FOLLOWING WORDS OR EXPRESSIONS:

Rachet up, Assessment, Segment, Constraint, Indexation, in for a rough ride, ripple off, poll, take heat, measure, odd, rampant, fair,

John Manley, Canada’s former Finance Minister, and current senior Business Advisor at Bennet Jones, speaks with Vassy Kapelos, a journalist.

He is concerned that Canada’s central bank will rachet up the interest rate to control inflation, by suppressing demands for goods and services.

He is concerned that rising interest rate will cause an economic recession. He believes that it is a fair assessment by another economist, who predicts that the odd for a soft landing of the economy is remote.

He believes prices will increase because of many factors, such as the ongoing war in Ukraine, which is impacting the prices of commodities, energy, food, nutrients needed for fertilizer, etc.

In his opinion, the government doesn’t have many options. The central bank is independent, an importance feature of our system that must be preserved, but that means the bank will raise interest rates, and the government cannot stop that.

To help those segments of the population that will suffer hardships because of high interest rates, rising prices and constrained supply, the government must accelerate the measures that it already has. Examples of those measures are benefit indexation, workers’ benefits, housing benefit, etc.

Mr. Manley believes we are in for a rough ride, because of food price increases and the things that will ripple off of those increases.

He believes that the inflationary pressure will decrease by the time of the 2025 elections, and the Liberals will not be as vulnerable as the Democrats in the US, who will go to the polls in November. People are consumed by worries, about price increases, mortgage payments, etc. Although it is a global phenomenon, the government will take a lot of heat from the opposition for the problems.